The Inflation Reduction Act brought about a historic opportunity for companies to reduce their effective tax rates by purchasing federal transferrable tax credits generated by green energy production, investment, or manufacturing.

For multinational corporations, however, this historic opportunity must be analyzed against international tax considerations, given the implementation of Pillar Two by many nations, creating an effective 15% global minimum tax rate.

Multinationals subject to the new global minimum tax that are planning to purchase transferable tax credits should evaluate the financial treatment of tax credits and the impact of Pillar Two.

What Is the Global Minimum Tax?

The Organization for Economic Cooperation and Development (OECD) is a global policy forum that promotes policies to improve the economic and social well-being of people around the world. The OECD introduced the Pillar Two Model Rules, also referred to as the Global Anti-Base Erosion Rules (GloBE Rules), as part of a framework for countries around the world to implement a 15% global minimum tax.

By establishing a 15% global minimum tax rate, OECD seeks to reduce profit shifting to low tax jurisdictions and to provide a more coordinated approach to ensure multinational businesses pay a consistent percentage of tax, regardless of their physical presence or geography.

While the OECD doesn’t have the authority to implement tax policy, nearly 140 countries have agreed to the GloBE Rules. The United States, however, hasn’t yet adopted the GloBE Rules, so US-based multinational corporations need to consider how the rules may impact them if they do business in countries that have adopted the rules.

The GloBE Rules include a transitional safe harbor such that if a company is headquartered in a jurisdiction that hasn’t adopted the GloBE Rules and that jurisdiction has a corporate income tax rate greater than 20%, no additional tax would be owed. This safe harbor applies to fiscal years that run no longer than 12 months that begin on or before December 31, 2025, and end before December 31, 2026.

The global minimum tax is applicable to multinational businesses with revenues of at least €750 million per year—approximately $795 million—regardless of where the income is derived and earned.

Generally, the GloBE Rules effective tax rate is calculated as adjusted covered taxes divided by net GloBE income. This is then compared to the 15% global minimum tax. If the tax rate is below 15%, the company would pay additional taxes to its headquartered country to meet the 15% minimum tax rate. This is commonly referred to as a top-up tax.

When a jurisdiction’s statutory corporate income tax is computed at a rate below 15%, then under GloBE Rules, a top-up tax would be imposed to bring the effective tax rate (ETR) to the minimum level. For jurisdictions with tax rates above 15%, there may be tax credits or other adjustments that reduce the tax base, triggering an ETR below 15% resulting in a top-up tax to ensure the minimum level of tax is paid.

For example, if a taxpayer has a taxable income of $100 arising in a jurisdiction with a 10% ETR, a $5 top-up tax is required to raise the taxpayer’s ETR to meet the minimum 15% required under the GloBE Rules.

How Global Minimum Tax Affects US Tax Policy

Even though the US hasn’t adopted the GloBE Rules, the global minimum tax significantly impacts tax policies at the domestic and international levels by reducing tax competition among countries with low tax rates. Currently, the US federal tax rate is above the 15% minimum tax; tax credits reduce the amount of tax due, lowering the taxpayer’s effective tax rate.

In the period before the Inflation Reduction Act, there were four main federal transferrable tax credits which, if transferred, required investment through an ownership structure, also known as tax equity:

- Renewable Energy Tax Credits

- Low-Income Housing Tax Credits

- New Markets Tax Credits

- Historic Rehabilitation Tax Credits

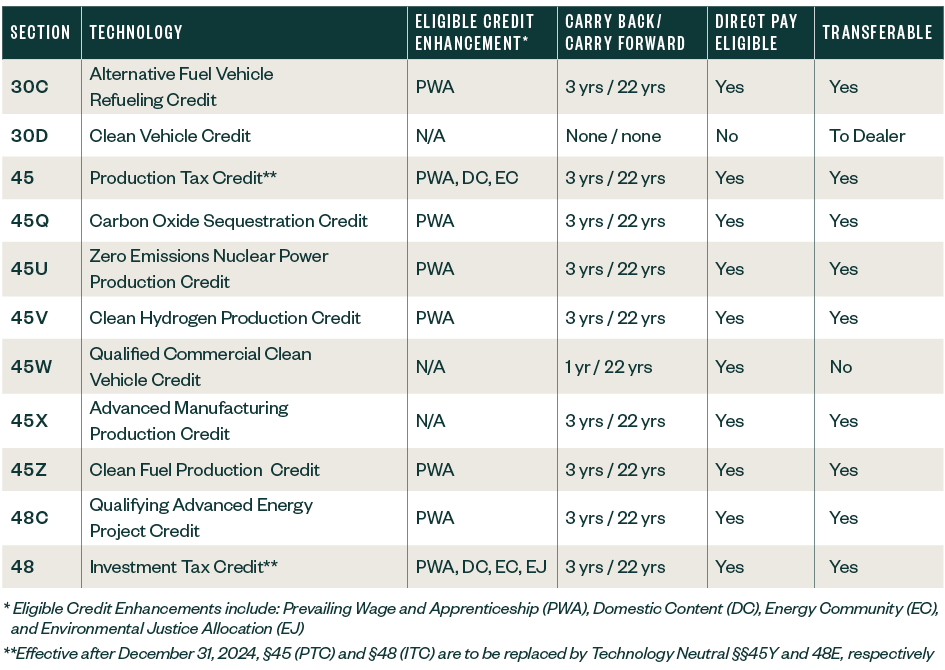

The Inflation Reduction Act reauthorized and expanded several renewable energy and green manufacturing credits and made eleven of those credits transferrable.

Inflation Reduction Act Transferrable Tax Credits

Sections 45 (PTC) and 48 (ITC) are to be replaced by Technology Neutral Sections 45Y and 48E, respectively, effective after December 31, 2024.

The treatment of these transferrable tax credits under the GloBE Rules can dramatically impact multinational taxpayers' ability to utilize them.

Transferable Credits and the Global Minimum Tax

The OECD provided administrative guidance concerning Pillar Two and the treatment of the Inflation Reduction Act transferable tax credits on July 13, 2023.

Under the guidance, when a tax credit regime provides for tax credits that are transferable, the credit will be tested to determine whether it’s a marketable transferable tax credit (MTTC) or non-marketable transferable tax credit (non-MTTC).

To be treated as an MTTC under GloBE Rules, there must be a market allowing for the legal right to transfer the credit, creating immediate practical and economic significance. The legal transferability requirement is met when the tax credit is designed so that the transferor can transfer the credit to an unrelated party in the originating year. The economic significance is met when the transfer is at a price that equals or exceeds the price floor.

When there’s no actual market for transferable tax credits, the transferability element will be of no practical significance to taxpayers, and Pillar Two will not treat the tax credit as an MTTC, therefore the credit will be treated as a non-MTTC. To be considered an MTTC to the holder of a credit, the credit must be transferable to another party.

Impact of GloBE Rules on Inflation Reduction Act Transferable Tax Credits

Tax credits may offset all or a portion of the income tax of the taxpayer holding the credits—and certain credits are eligible to be transferred in whole or in part to another party to be used to offset the tax liability of the transferee. Transferable credits in the Inflation Reduction Act may only be transferred one time.

Under GloBE Rules, transferable credits from the Inflation Reduction Act may have differing treatments depending on the party's perspective on the transaction. The credit will be considered an MTTC for the transferor because the transferor can transfer the credit to a transferee. However, in the hands of the transferee, the credit may not be transferred a second time. Because the transferee can’t transfer the credit again, the credit in the hands of the transferee will be treated as non-MTTC.

When a transferrable credit is in the hands of the transferor, the face value of the MTTC is treated as GloBE income in the originating year or within 15 months of the end of the originating year. When a transferor transfers an MTTC within 15 months of the end of the originating year, the transfer price—in lieu of the face value of the credit—is included in GloBE income in the originating year.

When the transferor transfers the credit after 15 months, the transferred price—any difference between the face value of credit—shall be included as a loss in its GloBE income in the period of transfer. This is because the face value of the tax credit transferred was previously recorded in GloBE income in the originating year.

When a transferrable credit is in the hands of the transferee, the credit is treated as a non-MTTC and can only be used to offset income tax expense within the list of covered taxes. The transferee would apply the non-MTTC to reduce income tax expense by the difference between the purchase price and face value of the transferred tax credit.

With this consideration, transferable tax credits under the Inflation Reduction Act can either have a favorable or unfavorable impact on the ETR under the GloBE Rules. Taxpayers should carefully model the impact of the credits to avoid a top-up tax.

Examples of Impact on MTTC under GloBE Rules

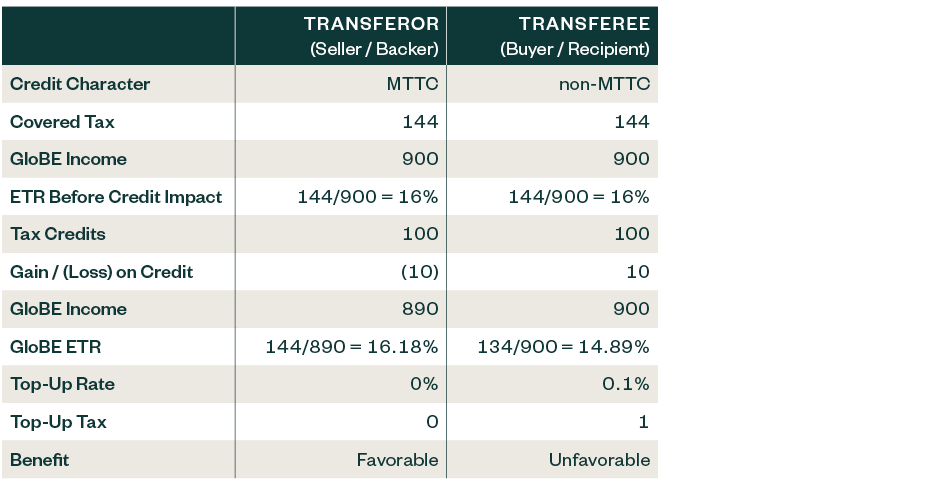

Under GloBE Rules, the transferor that sells an MTTC shall include the transfer price—in lieu of the face value of the credit—in its GloBE income. For example, assume the transferor generated $100 of MTTC and has a GloBE income of $900. When the tax credit is transferred to a transferee, it is sold at $90. As a result of the transfer, a loss of $10 on the credit is realized in the transferor’s GloBE income. Assuming the transferor has an income tax expense of $144, the net effective tax rate is 16.18%, which is calculated by dividing $144 by $890, resulting in no top-up tax, as it’s greater than the 15% minimum.

Under Pillar Two, the transferee’s Inflation Reduction Act credit is a non-MTTC since it cannot be further transferred. Thus, the credit is used to reduce income tax expense by the difference in the purchase price and face value of the non-MTTC. For example, if the transferee purchases a credit for $90, with a face value of $100, the $10 discount reduces the transferee’s income tax expense. Assuming the transferee has an income tax expense of $144 and GloBE income of $900, the non-MTTC would reduce the income tax expense to $134. The net effective tax rate would be 14.89%, which is calculated by dividing $134 by $900, resulting in a top-up tax, as it’s less than the 15% minimum.

As evident by the example, from the transferee’s point of view, it’s critical to understand the effect of the tax credit before determining how much credit to purchase and at what discount rate so as not to fall below the ETR threshold of 15%. Failure to properly model the effect of the purchased credit may result in the transferee not being able to utilize the full value of the credits purchased.

The below scenarios provide an example of each situation.

MTTCs Scenarios Calculated

Global Minimum Tax for International Corporations

Multinational corporations operating in the evolving landscape of global taxation are facing multiple tax complexities that present robust compliance requirements concerning overall tax liabilities.

The rules and mechanics of the global minimum tax computation introduce a new challenge in evaluating the effects of transferable tax credits in corporate strategies and business decisions to purchase and utilize tax credits.

Key considerations for multinational corporations include, but aren’t limited to:

- The importance of tax credit treatments for ETR purposes

- Proper modeling and management of ETR based on the perspective as a transferor or transferee when considering the sale or purchase of a transferable tax credit

- The implications of strategies to increase the value of transferable credits, including the timing of any tax credit purchase to align corporate strategies, such as cash flow improvement

Tax Planning with the Global Minimum Tax

With Pillar Two’s global minimum tax rate, there has been an increase in the need for comprehensive tax planning and modeling the impact of transferable tax credits. Taxpayers should strategically purchase transferable tax credits to avoid the top-up tax and ensure full utilization of the purchased credits.

We’re Here to Help

For insight into whether your company is eligible for these tax credits and incentives, or guidance on claiming them, contact your Moss Adams professional.